Hi everyone, welcome back to another newsletter, apologies for the lack of content over past 4 weeks, I am now full back to twitter and newsletter with full focus and I will try my best to get these newsletter’s out every friday for you moving forward. The past few weeks have been pretty manic, I have been relocating and moving across the country and moving into a new home so things are a little up in the air, but now finally getting back to full focus on the markets and more importantly this newsletter.

Firstly want to speak on Ronin and my position on $RON, still have not touched it since buying maybe 10 months ago now, as most of you know have talked about it in this newsletter many times over the past 6/7 months, and I have always been pushing the project on twitter. Still my largest altcoin position and still staking everything on the Ronin platform, well price has been performing incredibly well the past few weeks.

In the past 140 days, price has rallied 450%, and if you was entering at the lows, it is possible to be up as much as 700% in that time, a huge win for everyone who reads these newsletters and researches some of the project that I mention, especially when I have some much conviction. Ronin is still easily one of the most undervalued projects in the space from here, the 3rd most used chain after BSC and TRON and still a tiny marketcap in comparison, take some profits here if you wish but we have higher targets in mind for the rest of the year, especially with coinbase and binance incoming.

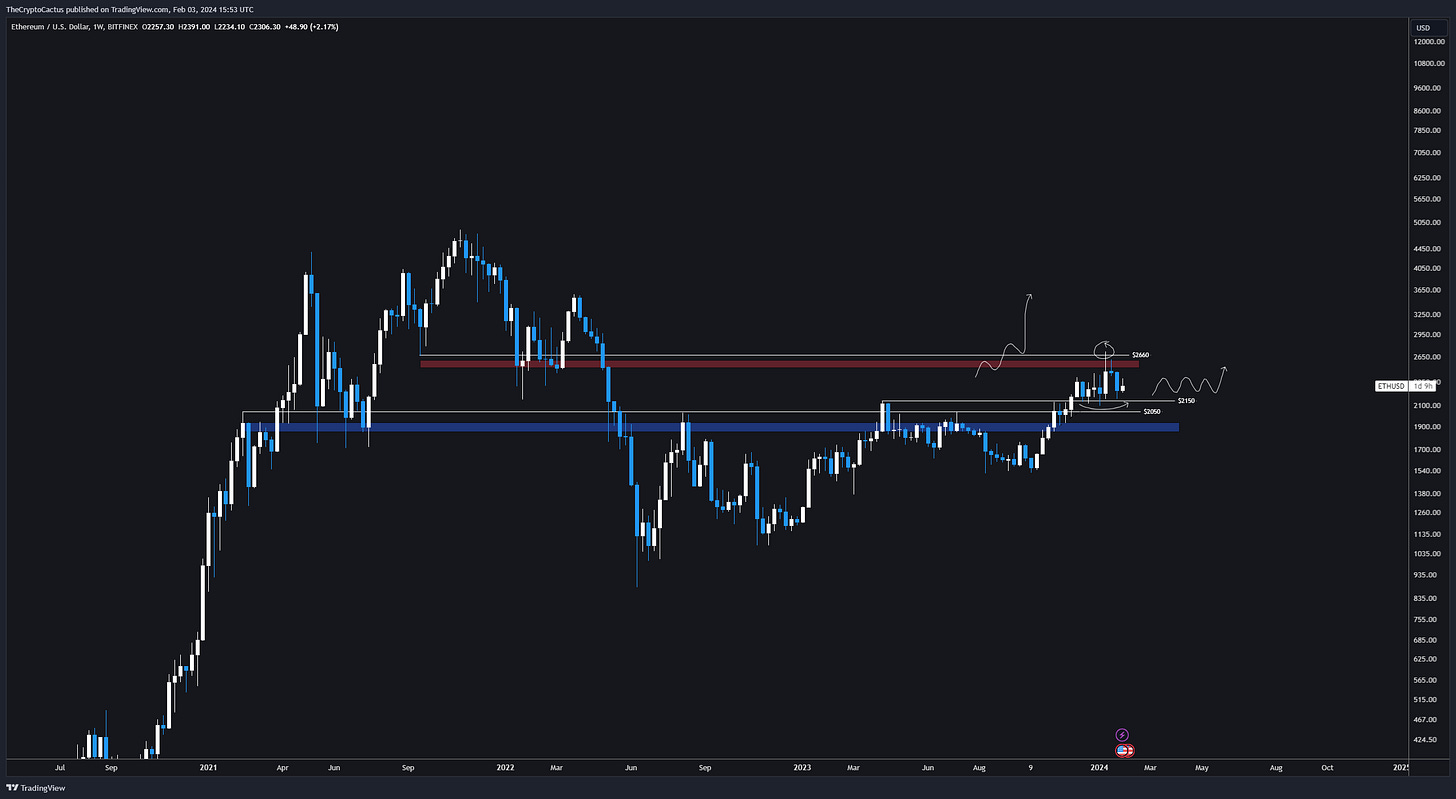

In regards to the rest of the market, and specifically ETH, things have been a bit slower since the start of the year, the price for ETH/USD pairing has been pretty flat generally, between $2200-$2400 with the only real divergence being upside tap in 2.7k

I think the market is just cooling off at so much upside in the last quarter of 2023, we saw close to 50% growth in the past 4 months so this level seems to be a logical place to just let the market cool, likely a bit of exhaustion after the ETF news, but nice to see the market moving sideways mostly without too much selling pressure.

As you can see from looking at the chart above, we have a good amount of buyers that step-in anytime price drops below $2150, this was previously heavy resistance multiple times during ‘23, so seeing support here is great, I am asking ETH to just keep moving sideways until the market settles and we finally move higher, keep an eye out on this resistance level at $2600, this is now the most important level to break moving forward, and likely once this level is flipped, price will soon quickly trade back above 3k, any wicks below 2k I am a heavy buyers, just still just holding.

One thing I have been showing the past few weeks is farming the airdrop for GRVT, the next-gen hybrid derivatives exchange powered by zkSync that is hopefully going to launch in the next few months. Currently for users who are signed up, you can complete challenges like connect twitter account, inviting friends and earning loot boxes that will be critical to receiving the GRVT airdrop. I only have 12 invites left this week, so first come first serve on the button above, but if you cannot get access I would try and find a invite and farm this airdrop, I think this can be a big winner.

In regards to BTC/USD pairing, we are pretty much at the same price that we opened the year with, around this $43,000 level that seems to be acting as both resistance and support at the moment, seems as though we are seeing a heavy amount of trades taking place, likely a lot of swapping of hands at the moment post ETF, bigger things at play with GBTC, I think honestly it good at the moment that price is stable.

I think look at the BTC chart that you can see above, it does seems as though the level to mark out for entry would be around $35,000 and honestly I do currently have some orders set at these levels 35/36k, and it seems as though it is a logical place for BTC to see at some point in the future, but one thing to note is that when price did begin to break lower below 40k just last week, buyers already heavily started stepping in at 38k, so buyers are still pretty aggressive when it comes to any signs of a dip into the 30’s.

I think the general outlook for this year and maybe partially of next year is mostly bullish, I think more and more ETF’s will contiue to get approved and we this cycle, will start to see the transition of Bitcoin from a internet currency transform into a more well regulated and hardened longterm investment option for wealth storage. We of course also have the BTC halvening fastly approaching another major bullish catalyst that usually results in price surging post event after a few weeks or month, this will likely be the main catalyst that kicks of the main bull cycle later this year.

I also believe that altcoins will perform considerable well over the coming year, I see little cause for concern with any major market correction, we have the US presidential election also this year, so expect the year to be pretty soft without to much bumps along the way. A Ethereum based ETF could be one of the things that really launches the altcoin market higher, I think this has a real chance of happening this year, at least some form of it, this is still why ETH is one of my main positions and I strongly believe we could see price at around $10,000 or more during this cycle.

I am also thinking about starting back up my youtube channel to provide one free video or livestream per week along with one free newsletter, I would love to get some feedback on if video based content is something you would be interested in, please do leave a comment below with any suggestions or thoughts on that.

Thank you for reading this Newsletter; if you did enjoy it and would like to stay up to date with any of my technical analysis moving forward, please do subscribe. I am currently trying to write something on the markets at least once a week.