8 September 2023

This newsletter is dedicated to sharing on-chain analysis for both Bitcoin and Ethereum, a Bi-weekly report that looks at some of the trending changes and movement on-chain so that subscribers can stay up to date with key information.

This report will run alongside the trading and price action based newsletter that usually gets written once a week, this should allow for subscribers to get the best of both worlds, a free newsletter covering on-chain data and trading/charts. If you are new here, please do subscribe, and thanks for everyone who supports this newsletter.

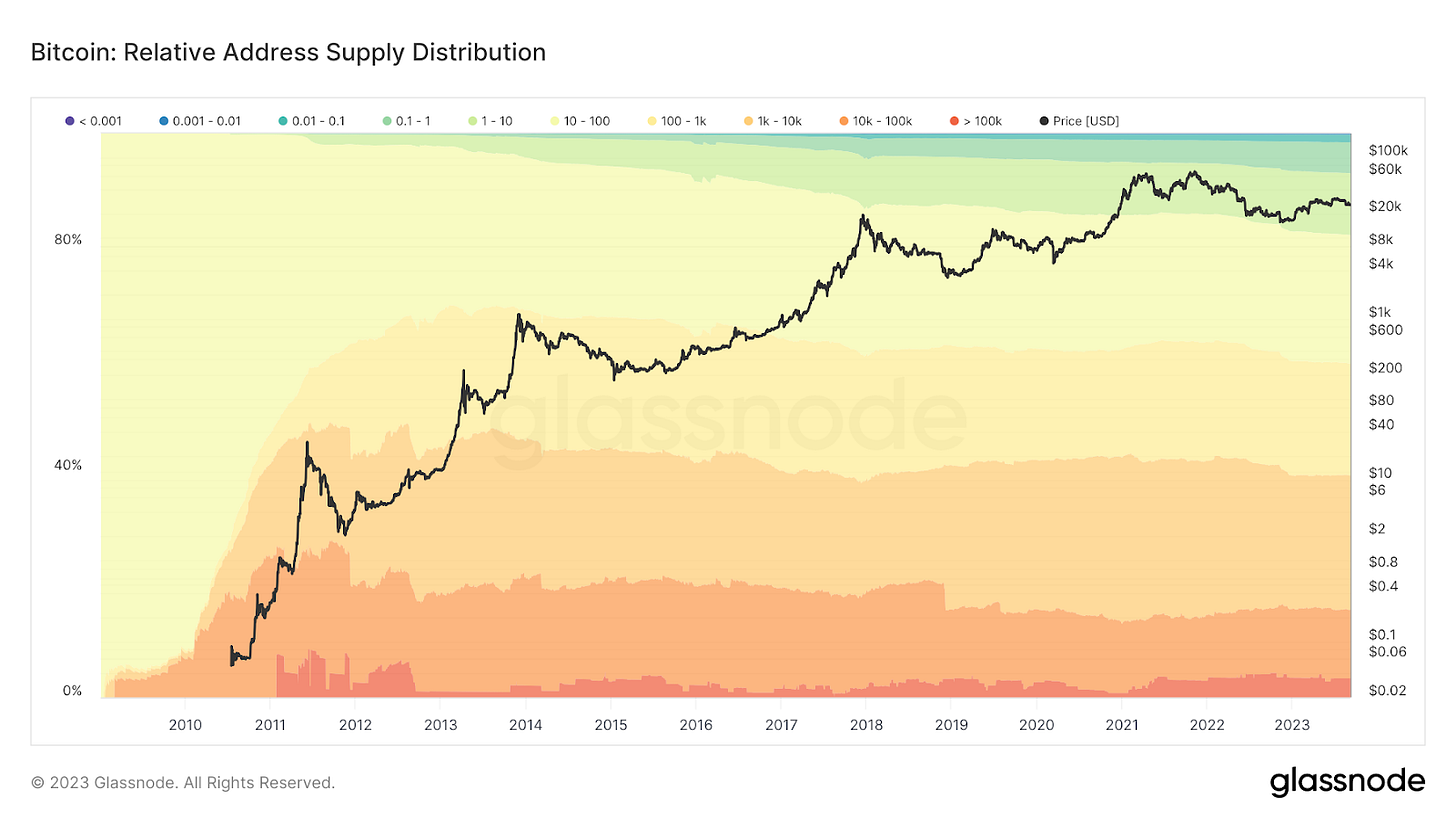

BTC Wallets Are Accumulating More

On-chain activity reveals the number of wallets with BTC balances and their respective ranges. The economic changes worldwide over the last 3 years have affected BTC as well as every risk-on asset, but not in the ways we expect. Addresses show that since January 2023, almost every category of address range has decreased, except for one – wallets with $100k or larger balance.

This is a good indicator to say that those that are accumulating BTC are still climbing in both numbers, and amount.

Despite this anomaly, wallets within the $10k range are the only wallets to increase in number since January 2023, leading to believe mid value wallets are also accumulating.

HODL Is Still A Thing, Especially for BTC

When looking at long term holds, we can see on-chain activity where holders are maintaining a balance through a longer period of time. This can often be seen as holding a conviction to keep Bitcoin or that people with more wealth are holding BTC as an asset class with its fixed supply at 21 million coins.

Reporting the findings, BTC is being held long term by the largest number of coins since 2017, which of current day the BTC holding value is marked at 14.6 million or 69.5% of the total supply that will ever be mined. Additionally, the holding percentage is up 7% YOY compared to 2022.

Looking further into on-chain data and the length of BTC asset holding, we can further into the holding supply. Since the Bitcoin ATH in November 2021, the number of holders have increased by over 260%. This is a good indication that we are getting more holders than before, despite BTC prices going to price levels seen in both 2017 and 2019 within the past 12 months. With this, we can conclude that (a) people are holding from the 2016-17 era, or (b) are holding at a loss and have no indication that they plan to sell.

Additionally, we further see that (b) is more likely considering the data reveals holdings above 2 years have also increased 55% and 12-24 month holds have increased 67%. It seems likely that the last 2 years of price performance has little effect on holding BTC, if not a reason to hold more.

This also gives a good indicator on relative hold performances as well, which we can see visually that holding in general has climbed 255% since January of 2023, a significant change relative to the ambiguous price action in the markets.

It’s worth noting that although HODL performance can most certainly fluctuate, it tends to be in tandem with market cycles with every significant recovery in the RHODL index tends to happen during the bottom of a bear market cycle. As we can see from the chart, the we are up 255% as mentioned but also under a recent consolidation, which is a pattern often seen at the first initial mark-up phase after a market bottoming.

BTC and ETH Supply Metrics

There are other metrics when looking at on-chain data that show the supply and demand of BTC in addition to an active supply within the Decentralized Finance sub-sector.

Looking at the BTC total active supply in the last 1-2 years, we notice that there is a record low movement in the past 10 months. This obviously correlates with the amount of long term holding we have seen, but would also signify that active retail trading is less warranted either from a lack of desire or opportunity. As we have seen previously, high wallet balances have only increased in the past 2 years, which we can conclude higher balance wallets are either holding regardless of price or waiting for a calculated move.

Current market conditions seem to reflect this as price action seems to be at a standstill and market participants seem to be at a relative all time low.

Additionally, we can take a look at how this is affecting the rest of the cryptocurrency market by looking at the Total Value Locked (TVL) in decentralized finance and in Ethereum. TVL is one of the obvious metrics that we can look at to determine how crypto is actively being used as a use-case, rather than a commodity in trading and investing.

The outcome however is bleak for the time being.

Metrics show that TVL has dropped 80% since the Ethereum ATH in 2021. There is also no immediate recovery as the total value locked is down 29% in 2023 despite ETH recovering from its low of $870. Put another way, ETH has recovered 85% while TVL has dropped 29% in the same time.

Are Exchanges Giving Any Insight?

In yesteryear, centralized exchanges were in complete dominance of the market and could give us a good beat on the health of the market. There are mixed views on this as exchanges are overall down on their balances, but the good news is CEX platforms are being more transparent about their holdings.

Overall, exchange balances are down 27% from exchange balance ATHs and down 17% from the Bitcoin ATH. In contrast, individual wallet balances are down 66% in the same time span. Much of these could be the nature of the market climate as BTC is down 62.7% from its ATH.

As mentioned, the market ecosystem has been much more transparent about exchange holdings, even giving on-chain proof of ownership. Since proof of holding could theoretically be more ambiguous in early years, the lack of holding may be more on par with previous years. The data does go back to 2016, so it's worth taking this theory with a grain of salt.

Thank you for reading this Newsletter; if you did enjoy it and would like to stay up to date with any of my technical analysis moving forward, please do subscribe. I am currently trying to write something on the markets at least four times a month.

Thanks for always taking the time to read, I appreciate the support and reads.

BOTTOM IS WHEN I GIVE UP. I AM ON FUMES and PISSED OFF!!!