On-chain Metrics - Exchange Deposits Nearing 2-Year Low & Network Activity Growth

Market Report #220

28 September 2023

This newsletter is dedicated to sharing on-chain analysis for both Bitcoin and Ethereum, a Bi-weekly report that looks at some of the trending changes and movement on-chain so that subscribers can stay up to date with key information.

This report will run alongside the trading and price action based newsletter that usually gets written once a week, this should allow for subscribers to get the best of both worlds, a free newsletter covering on-chain data and trading/charts. If you are new here, please do subscribe, and thanks for everyone who supports this newsletter.

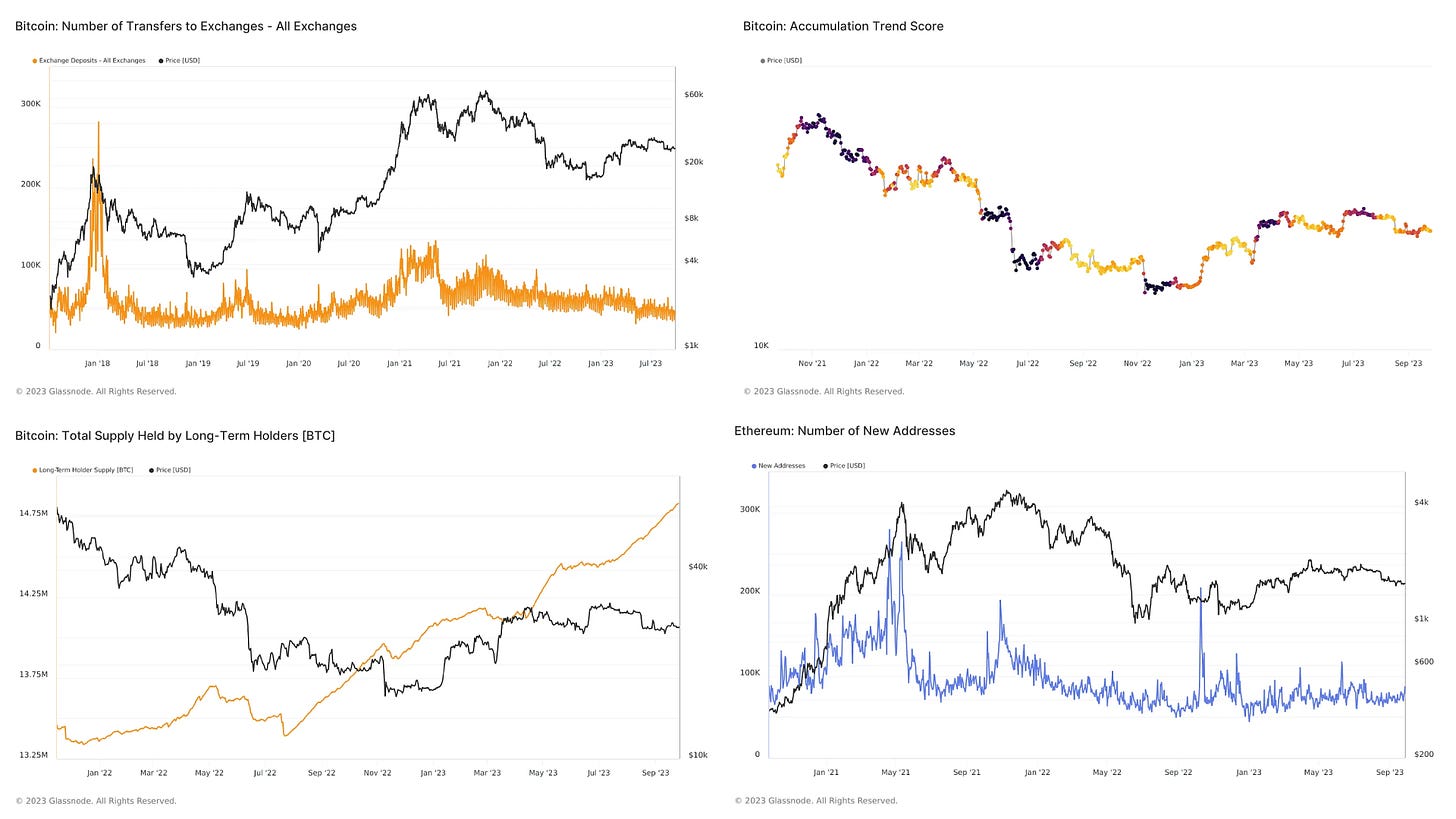

Exchange Deposits Are Near 2-Year Lows

Giving a look at the on-chain data provided for centralized exchanges, we can see how much Bitcoin is being deposited on most major exchanges in addition to other assets like ETH and USDC. The data is mainly streamlined into one major data point - that exchange deposits are nearing lows not seen since December of 2019.

In late September, deposits were approximately 48,000 in number, which mimics the amount from the last month of 2019 when Bitcoin was tracking at $8,000 USD. Furthermore, this 2-year low has been part of a freefall from November 8th, 2021 which is at Bitcoin all time highs. This may be a two-fold issue resulting from general market cycles (which was a similar pattern in 2017-18) and because of the lack of trust in centralized exchanges from events like the FTX fallout around this time last year.

Despite the pessimistic outlook on deposits, numbers are still up 33% from deposits made before the bull run in 2017.

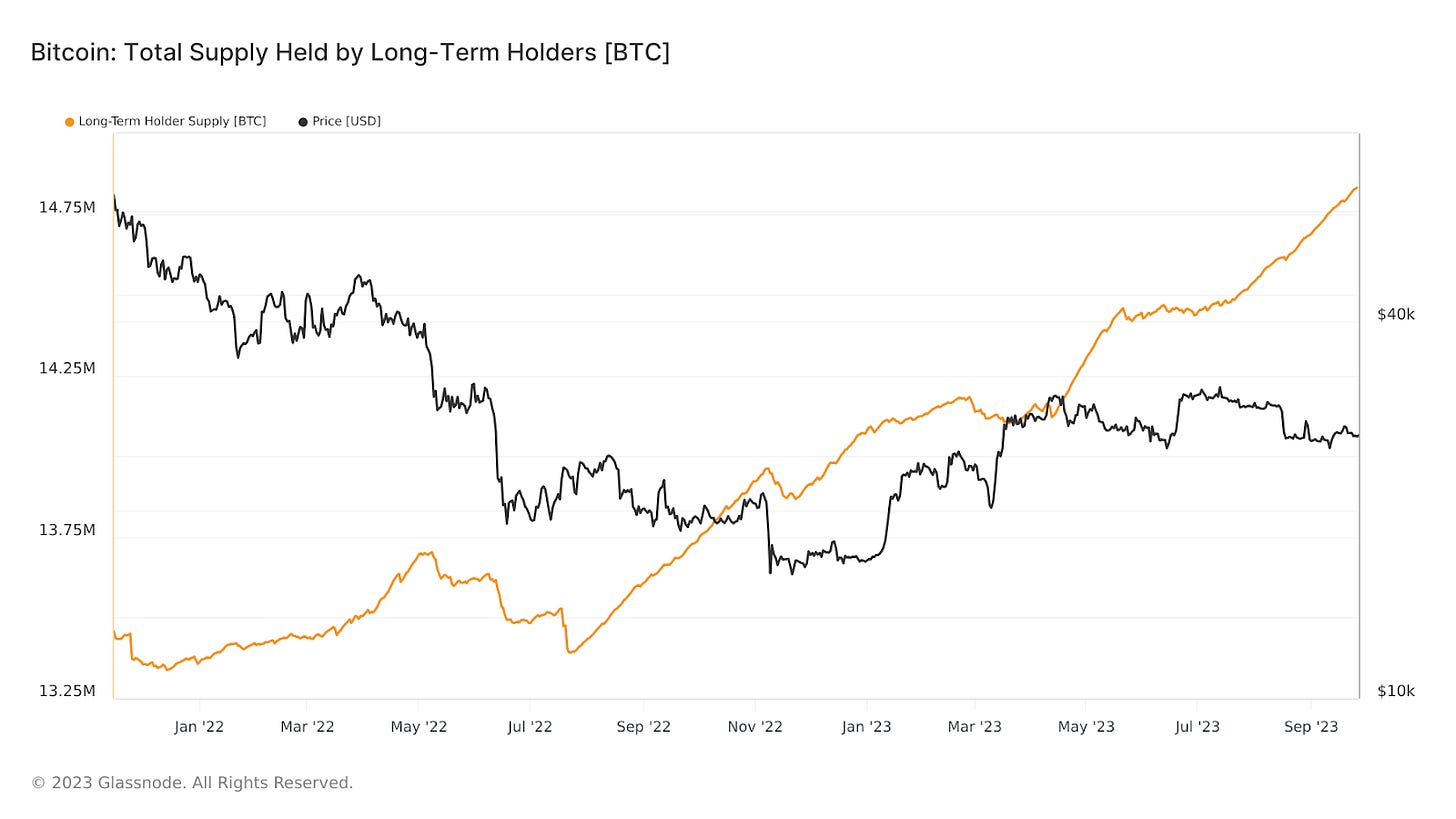

ETH Addresses Have Risen 8% Over The Past 30 Days

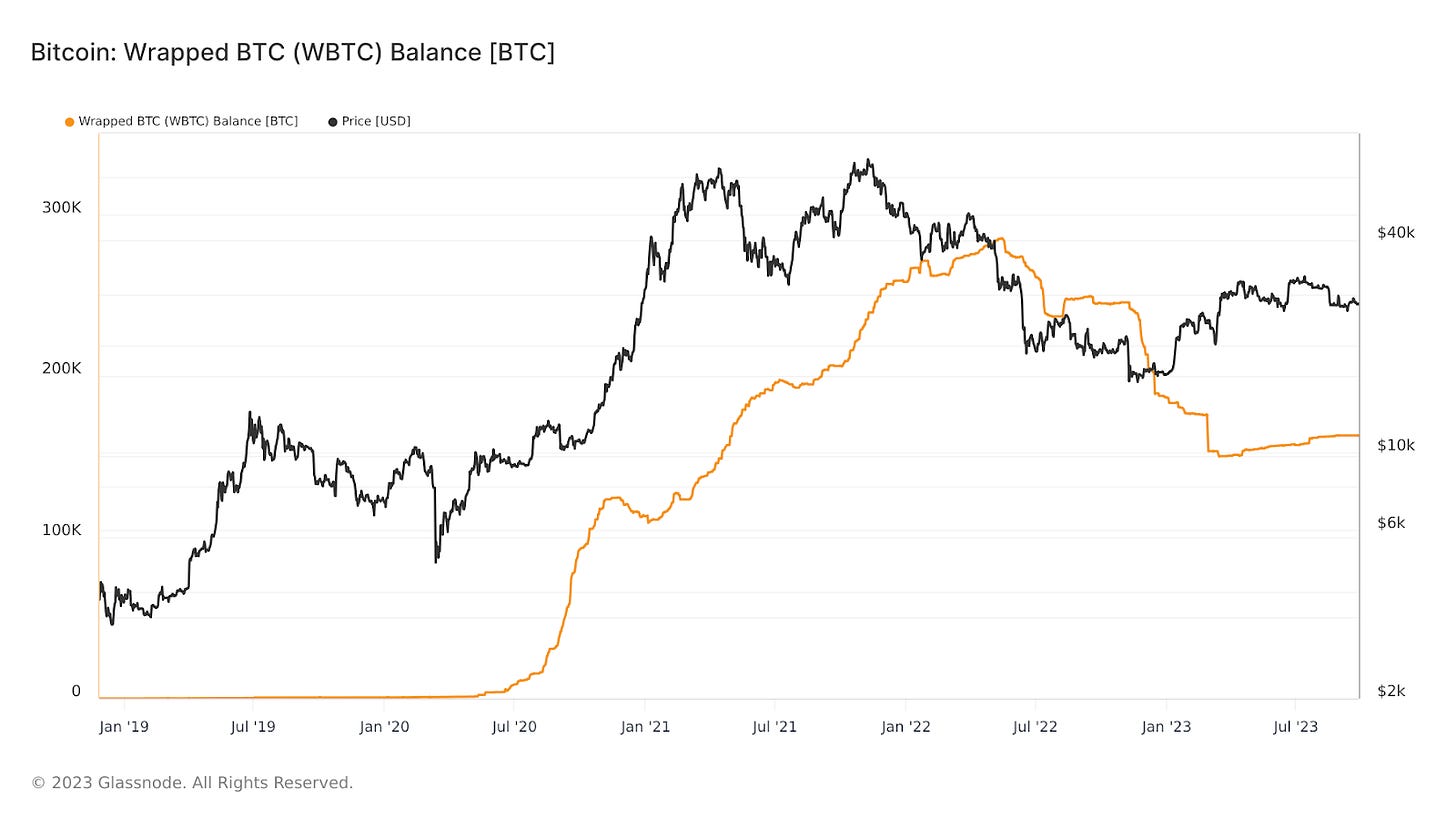

The Bitcoin deposits on centralized exchanges may be a cause of concern, but according to some data on other chains, this may not be the case. In the month of September, ETH Addresses have increased by 8.81% vs August. This is a major jump from addresses created and is the largest jump in the past 90 days, although still low compared to 1-year averages. This is also still above the generational low from September 2022. This could be a sign of rising interest from DeFi protocols and social projects like Friend Tech, but also worth noting that ETH on-chain transactions can also be used to store Bitcoin transactions like Wrapped BTC.

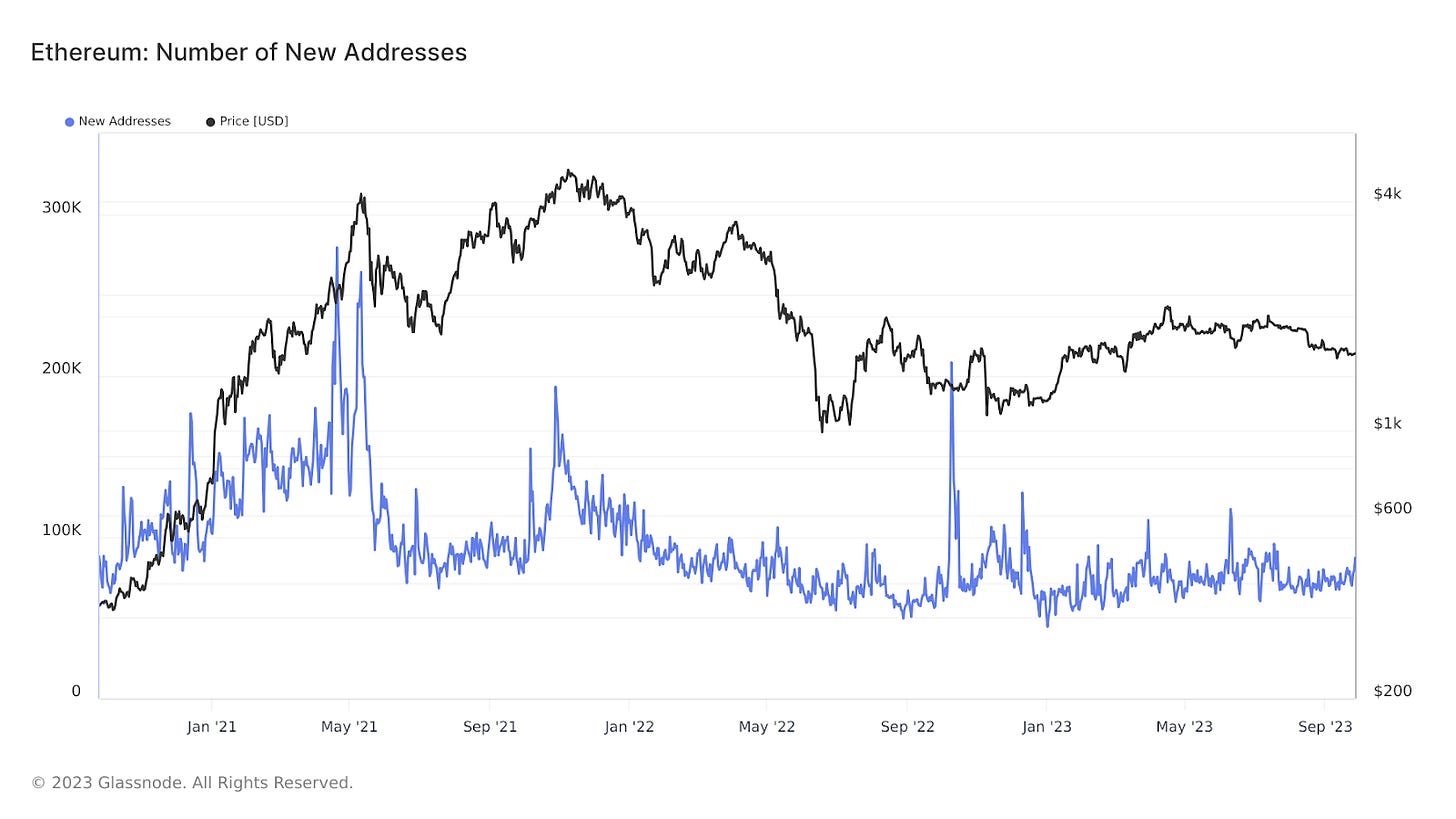

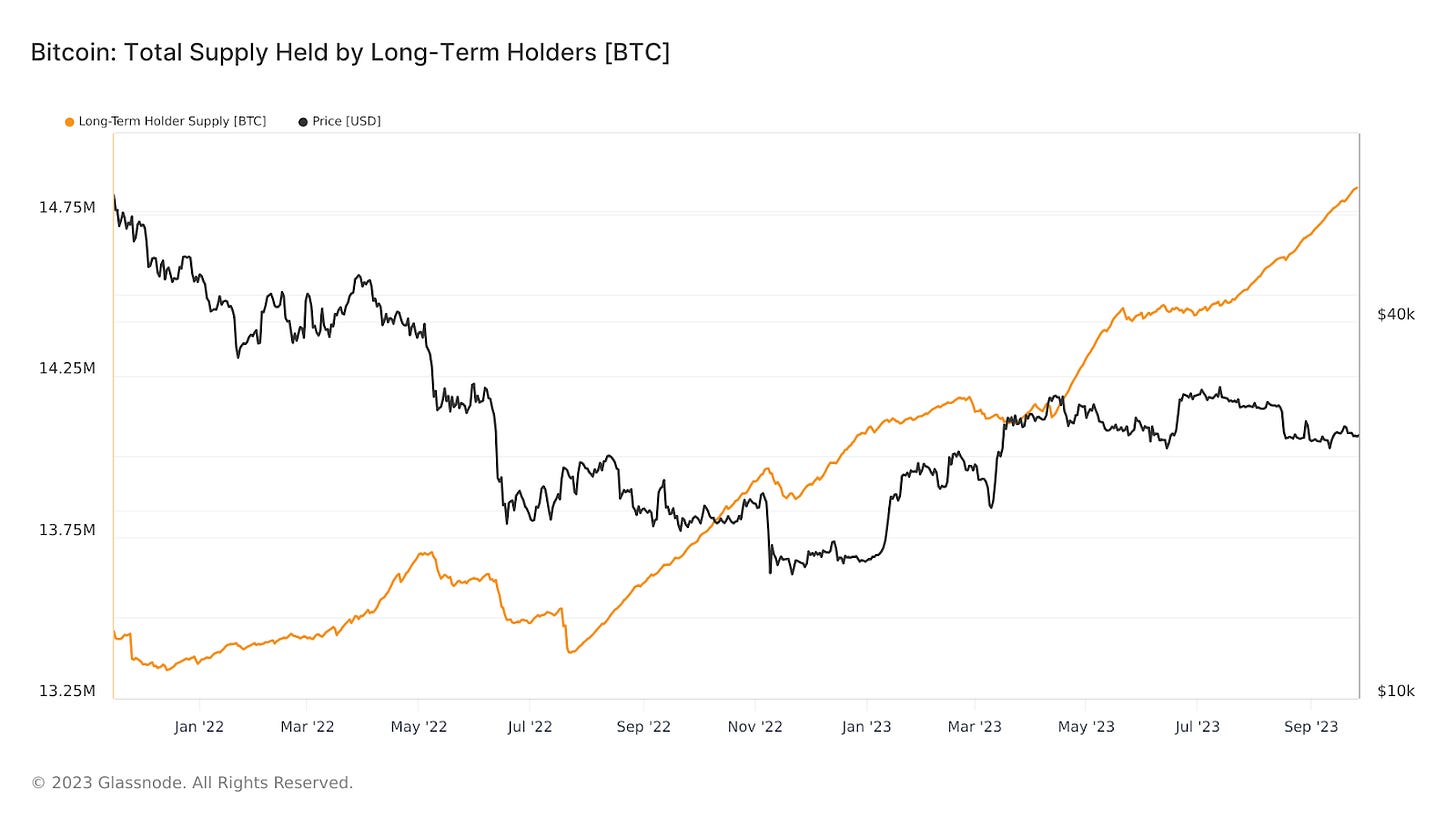

Bitcoin Holds Have Risen Steadily

Earlier this week, Michael Saylor’s MicroStrategy purchased $147 million worth of Bitcoin, putting his company into a position to own 158,000+ Bitcoin. As we look into the amount of Bitcoin that is being held long term, or possibly lost, on-chain data reports that BTC holding numbers are up 0.7%.

Bitcoin being held long term has been growing steadily over 2023. Since April of this year, BTC holding data has gone up a whopping 5% and 8% YTD. The recent 30 day jump of 0.7% accounts for almost 9% of the BTC being held this year, which could mean long term confidence is increasing.

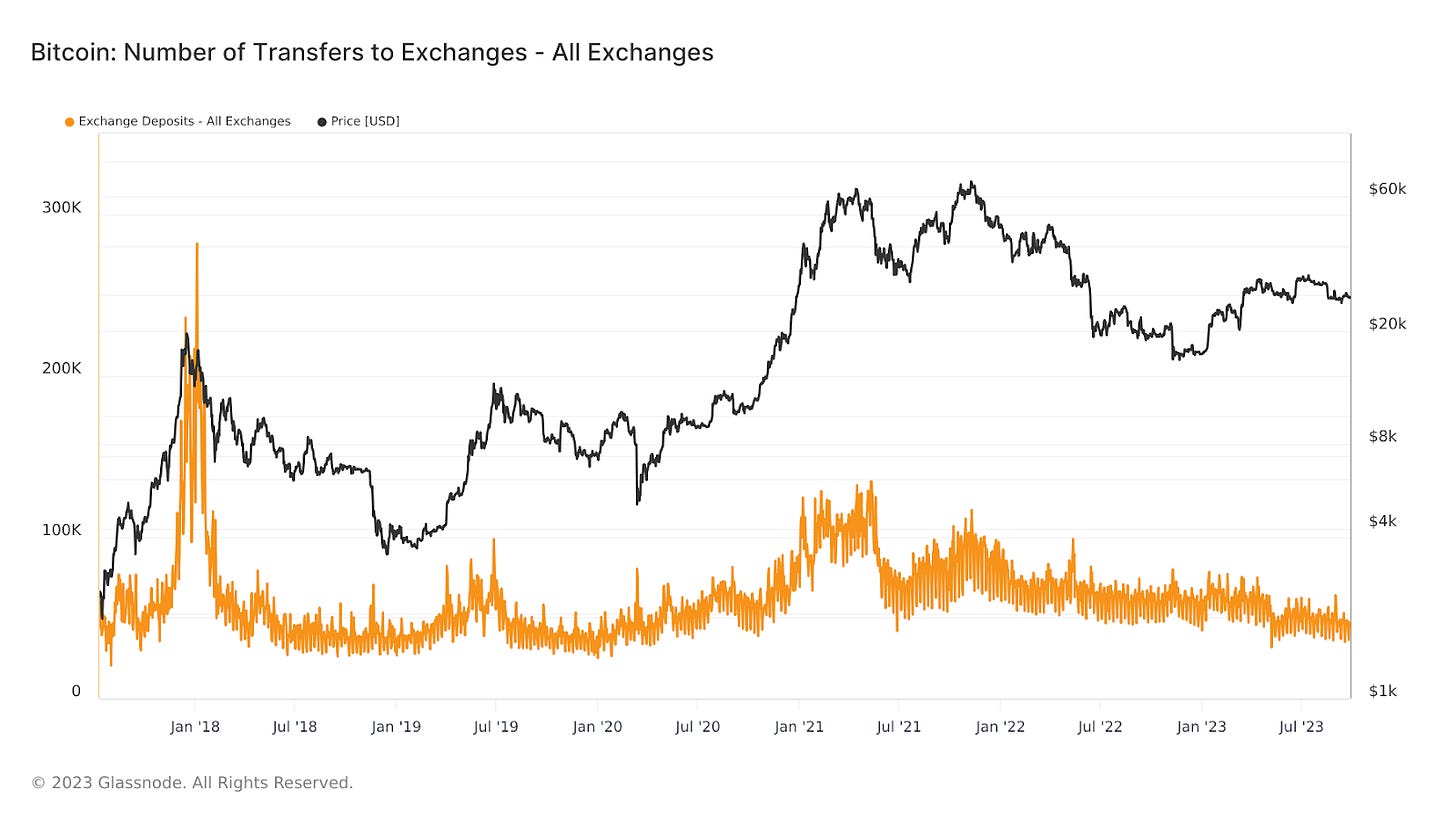

Despite the increase of long term holdings, the data suggests that many of the long term holdings are being done using multiple wallets or multiple places instead of one precise location. On-chain data suggests that accumulation per wallet is at a local low of about 14%. Although this does not match a yearly low, it is consistent throughout 2023 that wallets with an interest to accumulate are doing so on multiple wallets instead of just a single point of wealth.

BTC Has Been Silent, But Active

Although market price has been complicated and deposits have been down, there has been a massive increase in transactions in 2023 compared to previous years. Data shows that transactions have risen over 220% in the past 12 months. This shows significant activity on BTC, for both short term and long term transactions.

Despite the findings on the massive increase, this does not historically signify a market trend as this has happened both at market tops and bottoms, but could signify an increase of demand at the least and possible adoption growth for Bitcoin.

Taking a further look at wallets that engage on the Ethereum network, we can see that Wrapped Bitcoin (WBTC) has increased by 10.5% in the past 6 months. This increase is the largest surge in Wrapped Bitcoin in 2023 and the third largest increase in the past 18 months. This coincides with the idea that, despite overall deposits on exchanges being low, there is value being held on-chain. Combined with the long term holding and accumulation data, Bitcoin has been bought up more in recent months than in the past two years, showing favour to longterm accumulation.

Thank you for reading this Newsletter; if you did enjoy it and would like to stay up to date with any of my technical analysis moving forward, please do subscribe. I am currently trying to write something on the markets at least four times a month.

Thanks for always taking the time to read, I appreciate the support and reads.