Dear Traders,

So today is a little bit of a different newsletter, I wanted to talk and discuss a topic that is pretty common in the space with traders who I personally talk to but it still seems to fly under the radar of new or inexperienced traders. This newsletter will discuss the huge issues I have seen with the exchange ‘Bitmex’ over the past 2 years I have been using them to trade low leverage cryptocurrency. If you enjoy this newsletter please make to signup and I cover the markets a lot in terms of technical analysis…

The Issues

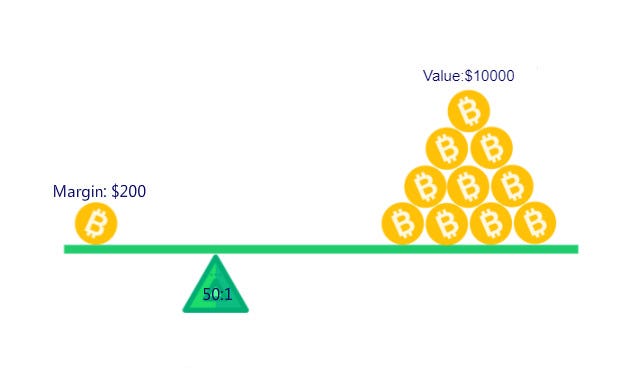

Bitmex seems to be that one exchange that all traders start to get involved with once they understand the basics of just buying and selling, they see the bright lights of leverage trading shining, like a brand new casino. It may be a little less common at current times just due to the fact that there are a lot more places to trade leverage instead of Bitmex, but two years ago Bitmex had pretty much the entire space using its platform to trade leverage on a daily basis. If you do not know what leverage is, it is pretty much a lending tool that exchanges use to increase your risk/reward by a large multiple, sometimes 10x, 25x, 50x and even 100x in some cases such as Bitmex, the more you have leveraged the easier it is for you to win/lose a trade.

I would also like to disclose here that trading with leverage is super risky and can have a major impact on your trading performance, if you are really sure you want to trade with leverage I would personally recommend sticking with around 3X as a max and making sure you using proper risk management for exiting a trade. Just be careful with leverage and make sure you have a complete understanding of the market first.

First I would just like to mention that exchanges such as Bitmex that offer such huge amounts of leverage produce a large majority of there profits from the liquidation of there users, their platform is designed for it to be simple to use and easy to lose. The whole business model itself is just sucking in new traders and trying to leverage them up with 100x before they really even getting a chance at knowing what is happening, and trading on 100x you pretty lose your capital instantly if a trade goes in the opposite direction. So straight off the bat, the system is against you…

Now, of course, it’s the user’s capital and the user is responsible for managing their own accounts so it’s hard to really blame Bitmex for this, but I just wanted to make the point that Bitmex’s intentions are to profit off there users losses and not hold there hand as they learn to trade, this exchange is for people who are experienced traders.

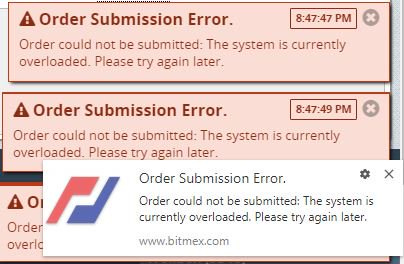

Now personally the main issue I currently have with Bitmex is the amount of downside and system overload that the exchange faces, as a trader the most important tool you have is the exchange you use, if that exchange lets you down every time there is some volatility in the market then there is a serious problem. Due to the amount of volatility traditionally in the cryptocurrency space, having an exchange that doesn’t overload and collapse every time the market gets a little crowded is probably not something that we should be looking for, it should really just be a community standard, especially when it comes to one of the biggest exchanges in the space.

I traded on Bitmex for pretty much a year, constantly running into ‘Order Submission Errors’, server overload and downtime, pretty much every time there was any volatility I could never close out of a trade or take profits, it was the most infuriating thing I have ever experienced and it completely made me fed up with losing trades that had nothing to do with my own strategy. This is one of the major downsides of Bitmex.

Another issue I have with Bitmex is that the business itself and how it is run is pretty secretive, there have been no external audits of things such as the trading desk or the insurance fund and nobody really knows how much of the market is controlled from ‘MM’s (Market Makers)’ or other parties that may also specialize in moving the price of the market in favor of the exchange. This uncertainty and concern over transparency is one of the other major factors as to why I stop using Bitmex for leverage trading, not knowing more about the exchange and how their business model is operated has left some doubt in my mind. There is also no way for users to get further insight into this and customers pretty much just need to take the word of Bitmex that everything is running above board, not something I want to believe in.

The fact we combine this huge volatility from market makers with the huge submission errors and downtime and we pretty have an unhealthy, hardcore exchange that pretty much just destroys users left, right, and center. There is no way of telling if market makers do have a large impact on price but what we do know is that Bitmex does and will profit from users being liquidated, from market makers or not. Taking all this into account Bitmex has become a ghost town for me, I haven’t traded on the exchange is probably over a year now due to the sheer amount of problems and I just really wanted to write this newsletter as I know a lot of you investors use the exchange on a regular basis and I just wanted to express my concerns and opinions.

(Just to clarify, this is my personal opinion and no views expressed in this article have any factual backing, I am speaking from a personal experience about my time on the exchange and I think it was only right that I share my opinions. Thanks for reading)

Where do I Trade now?

Just to follow up on this as I do get a lot of question about where I am currently trading, I am mainly using PrimeXBT these days, while this is not a sponsored newsletter I do have a good connection with the team and using the codes below you can grab yourself some free BTC on the exchange if you want. Prime has leverage, solid orders books and is quickly become one of the best exchanges in the space, so if you do want to switch up your exchange I will leave a few links below. Thanks!

If you would like to get a +50% deposit bonus for on exchange funds then just sign up with the link above and then in ‘promo codes’ use code CACTUS50. Enjoy!

Thanks everyone for taking the time to read this newsletter!