Solana, Solana, Solana, up over 120% in just the past 2 weeks alone and pretty igniting more excited into the crypto sector over the past weeks, Solana has been on a complete tear and while the rest of the major pairings have been lagging behind the whole market has seen a uptick in volume and things start to get ignited.

The likely reason for a uptick in the markets is due to weighing heavy optimism that the Securities and Exchange Commission, the US equivalent of the UK Financial Conduct Authority, will green-light the launch of an exchange-traded fund (ETF) based on the Bitcoin market price. We recently saw coindesk falsely break the news that the ETF was approved, and since that moment the whole market has been moving higher with BTC leading the charge, of course that news was not correct and was swiftly deleted, but ever since the sentiment for a ETF soon gets more and more bullish and it seems this is going to happen sometime in the next few months.

The most interesting read I made over the past week was from Vaneck, who released a digital insight analysis piece on Solana, and their prediction and outcome for bull and bear cases for the project up until 2030. I wanted to highlight and talk about some of the key takeaways from this research;

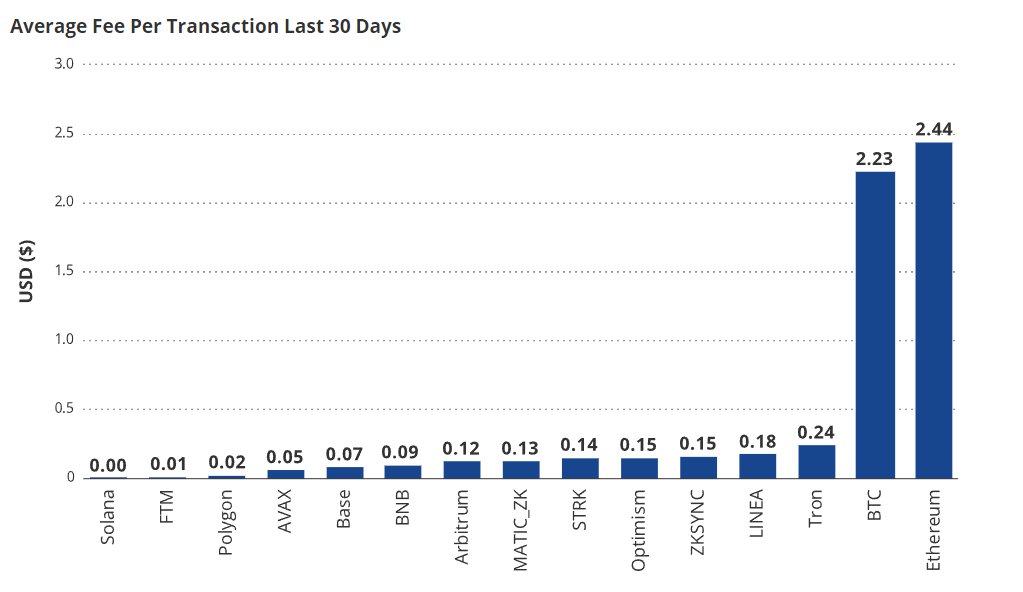

Of course the first major bull point as to why Solana to capture much more of the market share of the crypto industry is due to its extremely fast data throughput and transaction speed. Of course the obvious project they compare to is Ethereum being the major chain in the ecosystem, where they make the note ‘On Ethereum, users must wait for this entire process to unfold before they know their transaction is complete. Often, this is measured in minutes. Solana, by contrast, begins working on processing the transaction instantly, and the turnaround is approximately 2 seconds.’

Vaneck actually thinks that by 2030, even with the tiny amount of transaction fee’s being put back into the pocket of the network, just due to the shear amount of transactions and growth on-chain, in their base model, they assume roughly 600B in yearly transactions by 2030, with 534M monthly active users.

The Solana chain currently has around 250k active wallets that are transacting on-chain, so Vaneck think that growth with within the userbase is going to skyrocket around 2000x in the next 7 years which is defiantly possible if the crypto market surges to 10/20 trillion dollars marketcap and Solana is still a leading chain.

The most interesting part of the Vaneck piece of Solana is their structured breakdown, of all three Base, Bear and Bull cases for SOL up until the year 2030. I wanted to take a look at some key data points I think are interesting, the first being the Market Share that Solana may hold by that time, 80% being their bull and 30% being their base case, I think personally that 80 is way to high of a prediction, especially with Ethereum still looking like the main dominate chain with large fees, once these fees lower over time, Ethereum will likely have highest single market share. I think 30% seems way more realistic for $SOL and with the marketcap of the crypto likely being in the tens of trillions, price should readjust accordingly.

Solana FDV is another major factor when it comes to looking at possible price predictions for the end of the decade, their base case prediction right now is $231b, which is currently 13.5x from the current price today, the current marketcap is $17b so even on their base case the potential longterm is still pretty good. Their bull case, of course only being realistic if Solana did actually capture much larger marketshare , currently sits at around $2.1 trillion, which might sound crazy but all in all, actually does lean more in the realm of reality if the crypto industry is worth tens of trillions of dollars and is a global player in the financial revolution but the next wave of internet.

Of course the glaring price prediction on the page that has everyone taking is $3211 fore their bull case prediction on SOL, which yes might sound a little crazy right now, but I remember when the industry said the same about ETH at $80, and honestly if we see major growth in this space, I think while SOL might not be able to reach $3211 per say, I think price could get close to the $1500, which would of course mean substantial growth from where price is right now, 37x, and likely most of that gain comes in the next cycle throughout 2024 and 2025 as the space matures.

For those who read this newsletter on a weekly basis, I mentioned recently that SOL was one of my biggest positions going into the next bull market, and that I wanted to be accumulating in that $18/19 range or below for the foreseeable future, obviously that opportunity was cut short to say the least. Since the last 2/3 newsletter price has surged 120% since our entry, and now it is likely time to take some profits off the table as we run into this large block of resistance you can see chart posts at the top.

This for me is a quick trade, buying at $18 is defiantly a space position to be in, even if we do see SOL pullback in the shorterm, which is might even not, but I would like to rebuy with significant holdings if we can see $30/32 again in the next few weeks.

I think here it is hard to be a seller technically speaking, the time for being bearish is mostly likely over, after 2 hard years of bleeding, the market finally seems to be picking up some steam ahead of some exciting news events that will shape the space in the Q1/Q2 of 2024, I think the most realistic approach to this market right now is buying any major spot dips, starting to really aggressively increase your DCA approach if that is currently the method of getting back into the market, and by the new year I personally still want to be fully allocated to the crypto market as a whole with Solana being one of the largest positions, if not the single largest.