Introduction

Hi everyone, welcome back to a new newsletter, thanks for all the recent signups, in this newsletter we are going to be taking a look at some lower timeframe PA for both BTC, ETH and a few others alts, and also discuss the news on ETF approval this week.

If you really want to stay up to date with the price action of the crypto markets, feel free to drop this newsletter a signup, I have been writing about the crypto markets, protocols and general macro economy for free over the past 3 years now and we have had some crazy runs with profits and cycles during that time, stay tuned.

Bitcoin

Bitcoin has had a pretty boring time since the last newsletter, after we saw this larger drop in price that saw BTC testing this 25.2k support region, that we mentioned in the last newsletter would be critical if we want to keep mid to longterm bullish momentum. Since then, BTC has just be grinding higher slowly mainly trading between 26-28k with no real major move in either direction.

Price is actually only now a little bit lower than it was on 17th august before the large drop in price, this time hitting that level as resistance and not support, being the major difference within market structure. As you can see above we have seen 28.3k tested twice previously with only a wick to show for the effort, we need to see BTC break back above this level and reclaim it as support, if we want to be bullish here.

Looking at the macro chart above, you can see how important this level is to reclaim, in the previous bullmarket, this region at 28.3-30k was a significant region that supported price multiple times on BTC journey to discovery a new ATH.

The obvious analysis I can give right now is that, we can get macro bullish once that defined region has been flipped back into support, and until then likely price will continue to keep ranging between 24 and 28k until the market is ready to see continuation on a larger scale, with a chance the macro low’s get retest at 21k.

I am more than happy with just buying the dips, adding to longterm exposure, have no doubt that post havening price will be substantially higher later in 2024.

Ethereum

ETH is in a very similar position to BTC as we would usually expect, but likely a little bit under performing compared in terms of price action, with ETH having its major resistance level much higher at around 2k and still currently closer to major support at 1.6k. At least price action is pretty clear, with 2k being a definitive level that once broken will be a starting signal to more macro bullish conditions returning.

I think that during the next cycle ETH is going to be one of the largest moving altcoins in terms of ROI, I believe that a combination of real world adoption with Ethereum becoming a core component of future monetary and web applications, it is hard to see the token price of ETH not reach something between $10,000/15,000 a coin, this is defiantly in the realm of possibilities we need to think about looking forward, especially if a spot ETH is likely going to be hitting US investors next year.

On the topic of ETF’s the Ethereum exchange-traded funds (ETF) launched this week, underwhelmed speculators with a slow start in terms of volume. Nine ETH based Futures ETFs were introduced to the market this week, launched by investment firms ProShares, VanEck, Bitwise, Valkyrie, Kelly, and Volshares. However, upon their launch on October 2, ETH Futures attracted just under $2 million in flows.

“Meanwhile, on October 2, Grayscale joined the list of investment firms to apply for an Ethereum spot ETF. In a filing, the New York Stock Exchange (NYSE) made the request to the SEC.”

Futures ETF’s are fine, similar to when BTC launched, actually price declined slowly and interest was not at its peak, this is just another stepping stone on a route that is spot ETF’s, which is what we will be seeing for BTC and likely ETH at some point next year. The direct demand for spot ETH will likely be one of the major catalysts that help us achieve a marketcap above 1/2 trillion US dollars next cycle.

The reason as to why I believe $ETH has so much upside during the next market and why my price prediction might seem a bit crazy, is due to 2 main reasons, one being the financial impact; which we are already seeing with institutions and some of the the worlds largest traded funds, waiting to make public waves to retail investors and likely already accumulating at a heavy rate. The second reason why ETH likely outperforms so well, is due to the already increasing social and on-chain impact it has with DeFi, Gamfi, NFT’s and huge general adoption for application and content, the amount of wallets is increasing at an alarming rate and even though only around 430m people who use cryptocurrency worldwide, with huge brands adopting NFT’s and tokenization models increasing in the future, this number likely triples next cycle.

I think the crypto space is eyeing something like a total marketcap of around 10 trillion dollars next cycle, and with BTC and ETH spot ETF’s being accepted into the US and global awareness and adoption of digital assets seeing new heights, it is hard to really value just how high these major core assets can achieve in terms of price.

I am, and would not advice, wishing away this bear market/sideways action to quickly, right now seems like the perfect time to start really focusing on longterm accumulation of assets that have room for growth. I wouldn’t even put a focus on trading right now, just look at how to get money in and reduce money out, very similar times to 2018/19 when I was working 2/3 jobs at one time just to be able to accumulation more crypto, this is the mindset I have had since the end of summer.

Solana

This is how is goes in crypto, the trickle down approach, BTC leading the way with growth but substantially less returns, ETH outperforming due to a lower marketcap and being the dominate ecosystem and then lower marketcap altcoins seeing larger returns due to substantial higher speculation and significantly lower marketcaps.

Solana outside of BTC and ETH I see as being a major play for next cycle, defiantly has one of the highest ROI in terms of risk:reward. Behind ETH this is obviously the most used and most advanced L1 with wide scale adoption and protocol development within the space, just because FTX has a large % of the supply both locked and unlocked, which is still a concern for investors in the space, it seems beyond more than likely that in my personal opinion, ATH will be reached next cycle at a minimum.

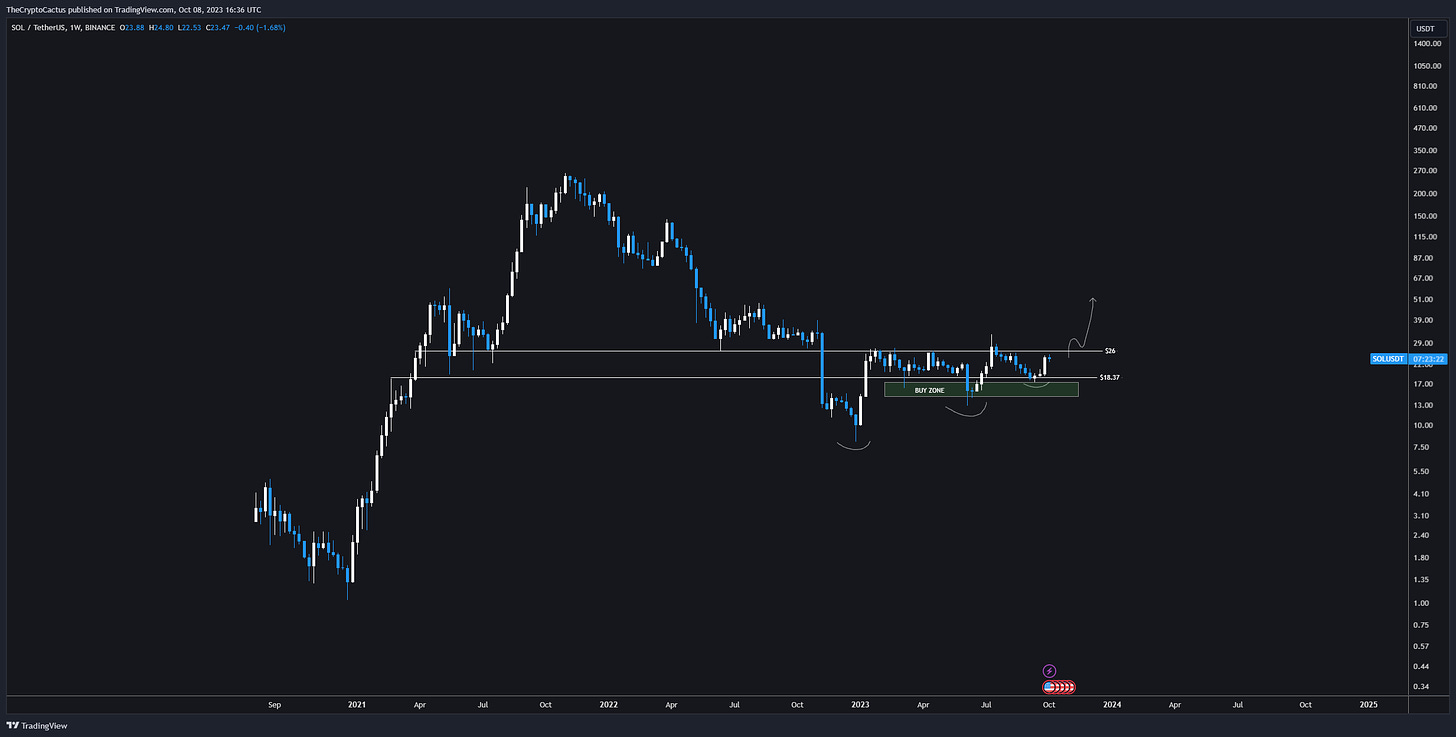

Similar structure to both ETH and BTC. but on a much tighter level, currently just trading sideways in this 20/25% range, low support being $18 and resistance being $26, price just moving sideways for a few more weeks or months seems fine with me. I think once we break $26 and see that level flipped back into support, likely similarly to BTC and ETH this is the shift towards a larger macro bullish picture. I like and have been buying anything close to $18.5 and think this is a strong level for longer-term holders, and anything under $18, I would likely be adding very aggressively.

We saw during the last cycle that Solana as a network, just works the best right now in terms of speed and optimized protocols that work efficiently, they gained a lot of user’s and attracted a lot of TVL just due to the shear amount of development on-chain, and even though price right now is being suppressed due to unknown circumstances with token unlocks, FTX and if the chain can make a big-come back next cycle, I would not be surprised if we see SOL trading closer to 400/500 next cycle.

The argument against this, would of course be that now other chains are starting to see adoption, we of course have L2’s that are looking to make a big stand next cycle with the likes of Arbitrum and L1’s such as SUI, AVAX and ATOM all in the race for marketshare, but I think once Solana concerns have been addresses in the hopefully near future, the on-chain impact and development of Solana is miles ahead of even some of the other top chains in the space right now.

Thank you for reading this Newsletter; if you did enjoy it and would like to stay up to date with any of my technical analysis moving forward, please do subscribe. I am currently trying to write something on the markets at least once a week.

Earn FREE Bitcoin by simply ‘Referring a Friend’

Thanks for always taking the time to read, I appreciate the support and reads.

Insightful. Thank you